Canada's AI Strategy

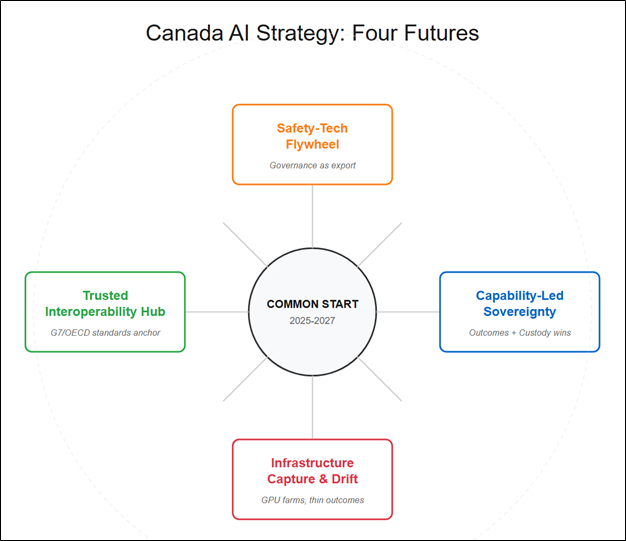

Four Futures

This strategic foresight post provides a framework for navigating Canada's AI future, grounded in current capabilities and infrastructure while remaining adaptable to emerging conditions.

This presents four plausible scenarios for Canada's AI trajectory grounded in the nation's current AI infrastructure. Each scenario emerges from common starting conditions in 2025-2027 but diverges based on policy choices, market dynamics, and international alignment. The analysis provides actionable signposts for monitoring which future is emerging and identifies no-regret actions across all scenarios.

Common Starting Point (2025–2027)

Canada's Pan-Canadian Artificial Intelligence Strategy remains capability-led (research, talent, commercialization), now reinforced by a surge in sovereign compute via the Pan-Canadian AI Compute Environment (PAICE) and a national AI package (~$2.4B). CIFAR (Canadian Institute for Advanced Research) stewards research/talent; CAISI (Canadian Artificial Intelligence Safety Institute) adds a formal safety layer.

Four Strategic Scenarios

Scenario A — Capability-Led Sovereignty (Outcomes + Custody wins)

Headline: Canada ties domestic compute to deployments and model/data custody; safety becomes a competitive advantage.

Logic of the world

Access-to-compute is conditioned on deployment milestones in priority systems (health, energy/grids, logistics, public services), with CAISI safety patterns (synthetic-content detection, privacy, human oversight) baked in. GPU-hours → capability-in-use becomes a national KPI.

PAICE clusters (TamIA at Université Laval, Vulcan at University of Alberta/Amii, Vector at University of Toronto) act as an integrated "domestic runway" for SMEs (small and medium-sized enterprises) and institutes.

What to watch (signposts)

Public dashboards reporting GPU-hours per deployed capability by domain

Model weights custody and audit cadence disclosed for projects trained on sovereign compute

Growth in Solution Networks moving from pilots to production (e.g., health imaging, diabetes risk)

Implications

Reduced vendor lock-in, stronger domestic IP position, higher trust in public-facing AI

Canada becomes a reference customer for safety-by-default AI, improving exportability of methods and tooling

Moves now

Tie compute credits to outcome gates

Publish custody/audit terms for all PAICE-trained models

Expand CAISI Catalyst Grants alongside SME Access Fund

Scenario B — Infrastructure Capture & Drift (GPU farms, thin outcomes)

Headline: Money goes into racks; outputs lag. Talent and startups orbit foreign platforms.

Logic of the world

Compute capacity scales, but allocation is throughput-not-outcome oriented. Few guardrails on data/model custody; safety remains an after-the-fact compliance layer.

Institutes keep publishing, but translation to production stalls; SMEs face cost/skills barriers even with access funds.

What to watch (signposts)

Rising PAICE utilization without corresponding production deployments

Non-transparent or ad-hoc custody and audit policies

Plateau in industry partnerships and start-up survival despite headline investments

Implications

Sovereign compute becomes a utility line item, not a strategic asset

Higher long-run costs (integration, switching), weaker bargaining power internationally

Moves now

Introduce "deployment-first" allocation rules

Require safety patterns (detection, privacy, oversight) as pre-conditions to GPU awards

Implement independent outcome reviews

Scenario C — Trusted Interoperability Hub (national, civilian-led)

Headline: Canada becomes the standards and assurance anchor for AI safety and interoperability across G7/OECD partners, accelerating deployments in health, energy/grids, logistics/ports, finance, and public services.

Logic of the world

CAISI (Canadian Artificial Intelligence Safety Institute) co-develops shared custody, audit, and incident-reporting templates with peer institutes (UK/US/Japan) and regulators; these are adopted in procurement and approvals.

PAICE (Pan-Canadian AI Compute Environment) hosts open evaluation benches (NLP, computer vision, reinforcement learning; domain suites for health/energy/logistics) used by domestic SMEs and foreign partners to earn "trusted AI" credentials.

CIFAR talent and Solution Networks speed translation (e.g., health imaging, diabetes risk, privacy-preserving synthetic data) into coalition-recognised deployments.

Signposts to watch

Foreign regulators referencing CAISI/PAICE evaluation or audit templates

Cross-recognition MOUs for model audits and weights custody across partners

Procurement frameworks in health/energy/public sector naming Canadian-origin safety modules (detection, privacy, human oversight)

Implications (national)

Faster approvals in regulated Canadian sectors; exportable assurance services for SMEs; stronger bargaining power on data/model custody

Canada "punches above weight" by setting practical trust rails rather than chasing raw GPU totals

Moves now (no-regret)

Publish open custody & audit terms (weights custody, data residency, red-team cadence, incident reporting) for any model trained on sovereign infrastructure; invite peers to align

Stand up domain evaluation benches on PAICE and issue public scorecards linking GPU-hours to capability-in-use in health, energy, logistics, and public services

Expand CAISI Safety Catalyst calls to co-fund reference implementations with ministries, hospitals, utilities, and port authorities; bake templates into procurement

Scenario D — Safety-Tech Flywheel (Governance as an export)

Headline: Safety becomes a product category. Tooling for detection, privacy-preserving AI, and human-oversight platforms scales; Canada sells the stack.

Logic of the world

CAISI programs and AI Safety Catalyst Grants generate reusable safety modules (synthetic-content detection, privacy assessments, human-in-the-loop governance). These harden deployments in healthcare and public services first, then propagate to finance and manufacturing.

Safety tooling integrates with PAICE training/evaluation pipelines, reducing time-to-assurance for SMEs and institutes.

What to watch (signposts)

Growth in firms offering safety components; inclusion of CAISI-origin methods in procurement frameworks

Solution Networks launching safety-first deployment playbooks (e.g., clinical AI)

Implications

Differentiated "Canadian-grade" assurance signals; higher trust and faster approvals in regulated domains; export revenues from safety tech/services

Moves now

Productize CAISI outputs

Co-fund reference implementations in hospitals, utilities, and ports

Certify assurance pipelines as shared infrastructure

Cross-Scenario Drivers & Tensions (to monitor)

Compute economics & energy: cost per training/eval, grid capacity, siting constraints—determine how much PAICE can carry domestically vs. spill to hyperscalers

Custody & audit norms: clarity on weights custody, data residency, third-party audits, red-team cadence, incident reporting—decides bargaining power and trust

Translation velocity: throughput from Canada CIFAR AI Chairs and Solution Networks to operational systems—core to Canada's advantage

International safety alignment: depth of CAISI's ties to UK/US/Japan institutes—sets Canada's leverage in setting the rules

SME on-ramps: whether AI Compute Access Fund plus evaluation/safety scaffolding truly lowers barriers for domestic firms

No-Regret Actions (robust across futures)

Outcome-linked allocation: Reserve a material slice of PAICE and Access-Fund capacity for projects with deployment KPIs and publish quarterly GPU-hours → capability metrics

Safety-by-default gates: Make CAISI patterns (detection, privacy, human oversight) pre-conditions to compute awards; maintain public audit logs

Custody & oversight terms: Standardize weights custody, data residency, audit/red-team cadence, and incident reporting for any model trained on sovereign infrastructure

Evaluation commons: Stand up open evaluation/red-team benches on PAICE (NLP, computer vision, reinforcement learning; domain-specific suites for health/energy/logistics)

Translate at speed: Expand Solution Networks in regulated domains; co-develop "last-mile" deployment playbooks with ministries/operators

How to Use This

Treat A–D as a board-ready frame. Pick your "most-helpful" future (A or C for upside; B for risk focus; D for commercialization strategy) and attach signposts you can measure.